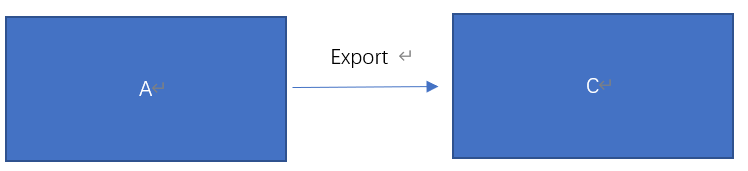

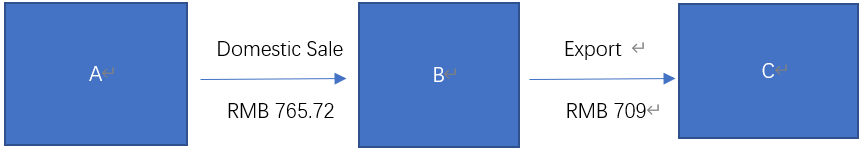

Assumptions :

A: Chinese Factory (Manufacturer)

B: Chinese Trading (Trader)

C: European Customer (Buyer)

Model 1: A->C

Export Price : FOB USD 100

Model 2 : A->B-C

Export Price : FOB USD 100

Domestic Sale Price : RMB 765.72 [USD 100*FX 7.09*(1+8% actual VAT rate)]

The suppliers only adds 7%-8% actual VAT rate

In the Model 2,

A: They are getting more fund (RMB 765.72 v.s. RMB709) and the actual VAT burden will be dealt by themselves

B: They could get some profits from this business model, the profit arises from the difference between 8% actual VAT and standard/nominal VAT 13% on Invoice.

Profit (accounting method)=Sales-cost of goods sold=USD 100* 7.09-RMB 765.72/(1+13%)= RMB 31.37 ;

Profit (Cashflow method) = Receival-payment +VAT refund = USD 100*7.09- RMB 765.72 + 765.72/(1+13%)*13%(88)=RMB 31.37

C: The customer pays the same cost in Model 1 and Model 2

But please note that

1. In Model 1 , the transportation costs include the factory to port and Customs Declaration costs ,which are probably paid by A and in Model 2, probably those costs will be borne by B ;

2. B will bear the Foreign Exchange risks (EUR v.s. USD /RMB)